"We published our first Climate Change Action Plan in September 2022 and received strong shareholder support for the Plan."

Jump to:

We work to minimise the impact of our activities and aim to create enduring value for our stakeholders, at each stage of the mining lifecycle.

Aluminium is often referred to as the metal of the future. It is lightweight, durable, strong, resistant to corrosion, recyclable and it can conduct electricity, meaning it has a wide range of applications including construction, electrical wiring, transportation, packaging and consumer goods such as electronics and household items.

Learn more about aluminium, alumina and bauxite and how we produce it.

1A definition of the term 'low-carbon aluminium' when used in the context of climate change is set out in the Glossary of terms and abbreviations at the end of the Annual Report document

Copper is a key metal used in electric vehicles and charging infrastructure. It is an excellent conductor of electricity, so as the world moves towards electrification, copper will increasingly be used in power-related infrastructure, including renewable energy. Copper is also used in kitchen cookware and plumbing as it conducts heat well and has antimicrobial properties.

In FY22 we acquired an interest in our first operating copper mine - a conventional open-cut copper mine in the prolific Antofagasta region in Chile, which transitioned to 100 per cent renewable electricity supply in FY23.

Silver is used in solar panels due to its superior electrical conductivity, and is also used to make medical appliances and consumer electronics.

Lead is used in renewable energy storage systems.

Zinc protects metals against corrosion and will play a key role in green infrastructure development as a protective coating for wind turbines and solar panels. In solar panels zinc oxide coatings help achieve higher energy conversion.

We are a large producer of silver-rich lead concentrate and zinc concentrate.

Nickel is used in stainless steel, which is used in transportation, manufacturing, household items and surgical instruments. Nickel has an important role to play as the world transitions to a more sustainable future as it is used as an alloy in wind and solar power infrastructure. Nickel-rich batteries are also critical for the rapid adoption of electric vehicles.

We are one of the world’s largest ferronickel producers with the potential to produce intermediary products for electric vehicles.

Currently there is no viable alternative to metallurgical coal in the steelmaking process. The use of high-quality metallurgical coal that we produce supports greenhouse gas emissions reduction targets in the steel industry through improved blast furnace efficiency, when compared with lower-quality metallurgical coal. Growth in steel demand is anticipated for green infrastructure development and vehicle electrification, as well as for the establishment of new steel capacity in emerging markets.

We produce premium-quality, hard coking coal for domestic and export steel markets.

Manganese is used to improve the quality and strength of steel in major infrastructure such as hospitals, office towers and bridges. Manganese also has the potential to displace cobalt in lithium-ion batteries, with demand for manganese-rich cathode chemistries expected to grow.

We are well positioned to meet future demand as we are the world’s largest producer of manganese and our Hermosa project has the potential to produce battery-grade manganese.

Our purposeOur purpose is to make a difference by developing natural resources, improving people’s lives now and for generations to come. We are trusted by our owners and partners to realise the potential of their resources. | ||||

|

We deliver on our purpose and our strategy by aligning our workforce behind seven ‘breakthroughs’ – commitments which shape our annual business planning process at corporate, operational and functional levels, enabling us to focus on what’s important. Our progress against those commitments and our delivery against our strategy in FY23 are detailed in our Annual Report.

Read about our progress on our strategy on pages 20-25 of our Annual Report

FY22: 1,375kt FY21: 1,370kt

Why it matters

Provides a baseline to easily benchmark our production performance against other mining and metals companies.

Performance in FY23

Strong production growth in aluminium, base metals and manganese reflecting recent portfolio improvements and three annual production records.

1 Copper equivalent production was calculated using FY22 realised prices, and includes operated and non-operated operations.

FY22: US$723m FY21: US$637m

Why it matters

Measures our approach to investing in safe and reliable operations, improvements and life extensions, and growth options.

Performance in FY23

We increased our investment in productivity, improvement and growth activities across our portfolio, including at the Hermosa project and reflecting the inclusion of Sierra Gorda.

2 Includes intangibles and capitalised exploration expenditure, and material equity accounted investments on a proportional consolidation basis.

FY22: US$3,967m FY21: US$1,039m

Why it matters

Underlying measures of earnings are important when assessing underlying financial and operating performance.

Performance in FY23

Production growth, coupled with our continued focus on cost efficiencies, supported one of our largest underlying financial results despite lower commodity prices and inflationary pressures.

3 This is a non-IFRS measure.

FY22: US$2,240m FY21: US$639m

Why it matters

Cash flow measures are important when assessing underlying financial and operating performance.

Performance in FY23

Lower free cash flow reflects higher capital expenditure and one-off tax payments in relation to our Sierra Gorda acquisition and non-core royalty sale.

FY22: US$788m FY21: US$460m

Why it matters

Provides an indicator for shareholders of how well their investment is performing.

Performance in FY23

We delivered record returns to shareholders during FY23 via ordinary and special dividends and our on-market share buy-back.

4 Fully-franked ordinary and special dividends paid in respect of H2 FY22 (US$784M), fully-franked ordinary dividends paid in respect of H1 FY23 (US$223M) and on-market share buy-back (US$218M).

FY22: 2.0 FY21: 1.7

Why it matters

Nothing is more important than the health, safety and wellbeing of our people.

Performance in FY23

LTIF reduced by 30 per cent compared to the FY22 baseline, reflecting a reduction in the frequency of severe events.

1 Incidents are included where South32 controls the work location or controls the work activity. Lost time injuries include injuries that result in one or more lost work days after the day of the event.

FY22: 78% FY21: N/A 2

Why it matters

Engaging directly with our people allows us to understand how they experience all aspects of South32 and identify areas for improvement.

Performance in FY23

Our employee engagement score, as measured in our Your Voice employee survey, improved by one per cent year-on-year.

2 Survey did not take place due to the impact of COVID-19

FY22: US$31.1m FY21: US$22.2m

Why it matters

We invest in local communities with the aim of contributing to their social, economic, and institutional development.

Performance in FY23

Social investment decreased by 11 per cent year-on-year, primarily due to social investment at Hillside Aluminium which is price-linked under South African legislation.

3 Our total social investment comprised US$24.6m in direct investment (including Enterprise Development), US$2.5m in administrative costs, and US$0.6m of in-kind support.

FY22: 66% FY21: 56%

Why it matters

Water is a valuable resource that we all share and a critical input for our operations.

Performance in FY23

Water use efficiency decreased by four per cent due to challenges faced at operations such as above average rainfall and management of excess water.

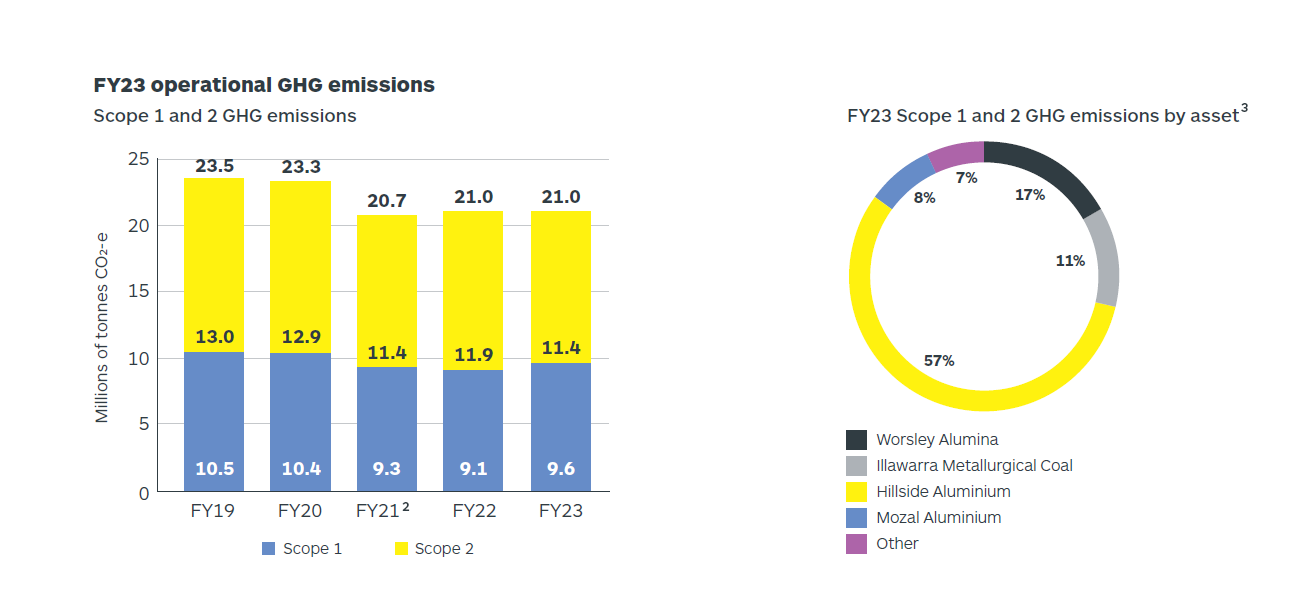

FY22: 21.0Mt CO₂-e FY21: 20.7Mt CO₂-e5

Why it matters

Human activity is causing climate change and the impacts are affecting ecosystems, biodiversity, and communities around the world.

Performance in FY23

Our reported Scope 1 and Scope 2 greenhouse gas emissions increased by 0.2 per cent year-on-year, with Scope 1 emissions increasing by 0.5 Mt CO2-e and Scope 2 emissions decreasing by 0.4 Mt CO2-e.

4 Includes Scope 1 and Scope 2 greenhouse gas emissions.

5 The FY21 baseline has been adjusted to exclude emissions from SAEC and TEMCO, which were divested in FY21.

Risk management is fundamental to maximising the value of our business and informing its strategic direction. Effective risk management enables us to identify priorities, allocate resources, demonstrate due diligence in discharging legal and regulatory obligations, and meet the standards and expectations of our stakeholders. Read more on pages 28-37.

We increased our supply of commodities critical for a low-carbon future, recording strong production growth as we realised the benefit of recent portfolio improvements. Read more on pages 38-62.

Includes information about our Board members and their activity in 2023. Pages 64-75.

Describes our approach to Executive and Non-Executive Director remuneration, and our FY23 Business Scorecard and remuneration outcomes. Pages 78-103.

Includes detailed financial information such as income statements, balance sheets and more. Pages Pages 105-167.

Details our Mineral Resources and Ore Reserves (including Coal Resources and Coal Reserves) inaccordance with the 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves. Pages 169-177.

Footnotes

1 FY23 growth in copper equivalent production at our base metals operations (Sierra Gorda, Cannington and Cerro Matoso), compared to FY22. Copper equivalent production

was calculated using FY22 realised prices.

2 Fully-franked ordinary and special dividends paid in respect of H2 FY22 (US$784M), fully-franked ordinary dividends paid in respect of H1 FY23 (US$223M) and on-market share

buy-back (US$218M).

3 In this report we use particular terminology in relation to climate change. Definitions of the terms 'goal', 'target' and 'low-carbon' when used in the context of climate change

are set out in the Glossary of terms and abbreviations on pages 181 to 187 of the annual report.

4 Our medium-term target is to reduce our operational greenhouse gas emissions by 50 per cent from FY21 levels by 2035. The FY21 baseline has been adjusted to exclude

emissions from SAEC and TEMCO, which were divested in FY21.

5 Copper equivalent production was calculated using FY22 realised prices, and includes operated and non-operated operations.

6 This is a non-IFRS measure. For an explanation of how South32 uses non-IFRS measures, see page 38 of our Annual Report.

7 Incidents are included where South32 controls the work location or controls the work activity. Lost time injuries include injuries that result in one or more lost work days after

the day of the event.

8 Our total social investment comprised US$24.6m in direct investment (including Enterprise Development), US$2.5m in administrative costs, and US$0.6m of in-kind support.

9 Includes Scope 1 and Scope 2 greenhouse gas emissions.

Our approach to sustainability comprises five interconnected pillars which focus on areas that are material to our business and stakeholders.

While our business has many positive impacts, we also recognise that our activities have the potential to cause adverse impacts. We are committed to continuously improving our sustainability performance, optimising our positive contributions and minimising adverse impacts by protecting and respecting our people, delivering value to society, operating ethically and responsibly, managing our environmental impact and taking steps to address climate change.

Our Sustainability Policy reaffirms our commitment to sustainable development and outlines our commitment to governance and transparency on sustainability matters. Approved by the Board, our Sustainability Policy is guided by international standards and initiatives, including the ICMM Mining Principles, the United Nations Global Compact (UNGC) Ten Principles, the Global Reporting Initiative (GRI), the Taskforce on Climate-related Financial Disclosures (TCFD), and the United Nations Sustainable Development Goals (UN SDGs).

Scroll down to continue reading, or click a link below to jump to a specific section.

Protecting and respecting our peopleHealth and safetyPeople and culture | Delivering value to societyPartnering with communitiesOur societal contribution |

Operating ethically and responsiblyEthics and business integrityHuman rights Responsible value chain | Managing our environmental impactWater | Biodiversity | TailingsWaste, contamination and other emissions Closure |

Addressing climate changeJump to section |

¹ In November 2022, we were devastated by the loss of two of our colleagues, Mr. Cristovão Alberto Tonela and Mr. Alfredo Francisco Domingos João, who were fatally injured in an incident while undertaking maintenance work on a raising girder at Mozal Aluminium.

² Incidents are included where South32 controls the work location or controls the work activity. Lost time injuries include injuries that result in one or more lost work day after the day of the event.

³ Incidents are included where South32 controls the work location or controls the work activity. Recordable illnesses include illnesses that result in medical treatment, restricted work or lost time.

¹ Read more in our Addressing Climate Change section

² Our total social investment comprised US$24.6m in direct investment (including Enterprise Development), US$2.5m in administrative costs, and US$0.6m of in-kind support.

³ Includes operations at their respective percentage shareholding, including South32's ownership proportion of our manganese equity accounted investments, and excludes Sierra Gorda.

4 Includes South32’s ownership proportion for equity accounted investments

¹ Enterprise and Supplier Development (ESD) consists of two activities, Enterprise Development and Supplier Development. The Enterprise Development component, which was

US$5.2 million in FY23, is captured in both the ESD total and the social investment total.

² Target set in FY21 as 10 per cent year-on-year increase in procurement of goods and services from Aboriginal and Torres Strait Islander businesses.

³ Local procurement is the direct purchase of goods and services within the local communities in which South32 operates. Suppliers are deemed as local based on their proximity to our local communities, including boundaries defined by local government areas, provinces and states.

¹ All required operations have a biodiversity management plan in place. All of our 'operated operations' require biodiversity management plans, excluding Mozal Aluminium

¹ In FY23, our calculation was revised to include tailings reused as well as tailings recycled. Numbers for prior financial years reflect tailings recycled only.

¹ Hazardous mineral waste is based on classification by local legislation. This includes hazardous mineral waste from processed raw materials, non-hazardous waste that is comingled with hazardous materials, as well as tailings, slimes, sludge, residues, slag, fly ash, gypsum and coal rejects.

We also have a medium-term target² to halve our operational GHG emissions by 2035 from our FY21 baseline³.

We are working to deliver our goal and target as described in our Climate Change Action Plan (CCAP) which was published in September 2022. The Addressing Climate Change section of our Sustainable Development Report (Pages 87-117), along with our Sustainability Databook, provides our first annual update of progress in delivering our CCAP.

Our approach to climate change is aligned to our purpose and integrated with our strategy, and is focused on:

¹ ‘Goal’ is defined as an ambition to seek an outcome for which there is no current pathway(s), but for which efforts will be pursued towards addressing that challenge, subject to certain assumptions or conditions.

² ‘Target’ is defined as an intended outcome in relation to which we have identified one or more pathways for delivery of that outcome, subject to certain assumptions or conditions.

³ FY21 baseline adjusted to exclude GHG emissions from SAEC and TEMCO, which were divested in FY21.

⁴ Low-carbon refers to lower levels of GHG emissions when compared to the current state. Where used in relation to South32’s products or portfolio, it refers to enhancement of

existing methods, practices and technologies to substantially lower the level of embodied GHG emissions as compared to the current state

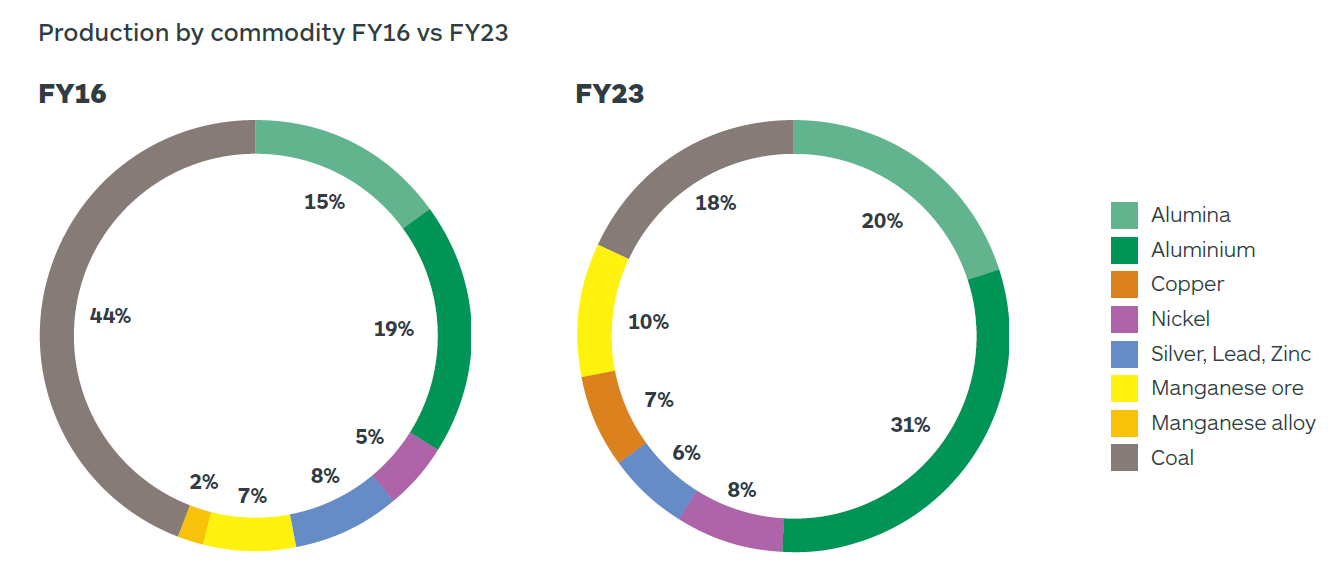

The graphic below shows how our commodity mix has evolved from FY16 to FY23. In FY23, we delivered 14 per cent growth in aluminium production and 17 per cent growth in other base metals production, as we realised the benefit of FY22 transactions that increased our exposure to these commodities.

Our reported Scope 1 and Scope 2 GHG emissions for FY23 were 21.0 Mt CO2-e, a 0.2 per cent increase from our FY22 GHG emissions and a 1.6 per cent increase from our FY21 baseline.

Scope 1 GHG emissions from activities at our operations increased in FY23 by 0.5 Mt CO2-e, while there was a decrease of 0.4 Mt CO2-e in GHG emissions from electricity used by our operations (Scope 2).

¹ FY21 baseline adjusted to exclude GHG emissions from SAEC and TEMCO, which were divested in FY21

² FY21 GHG emissions adjusted to exclude GHG emissions from SAEC and TEMCO, which were divested in FY21.

³ The sum of the categories may vary to the total figure due to rounding.

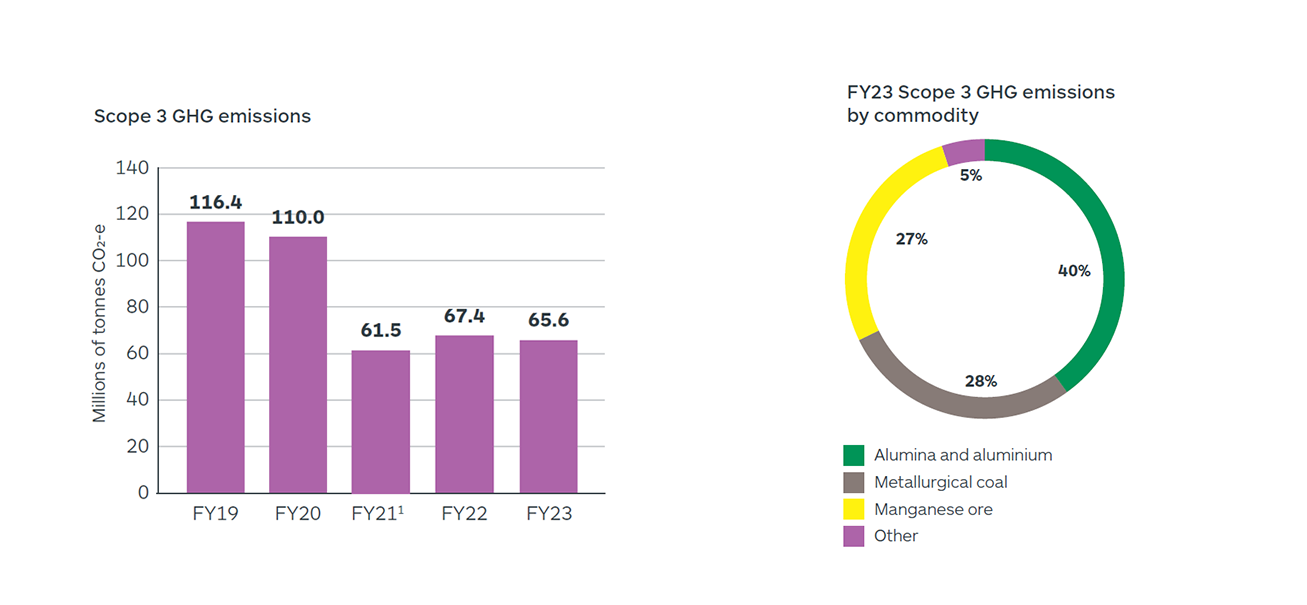

In FY23, almost 90 per cent of reported value chain GHG emissions were attributable to the downstream use and processing of our products, in particular the processing of alumina to manufacture aluminium ingots and use of metallurgical coal to make steel.

¹ FY21 GHG emissions adjusted to exclude GHG emissions from SAEC and TEMCO, which were divested in FY21.

Note: Estimate of Scope 3 GHG emissions by commodity

are based on processing and use of sold products, and apportionment of other categories.

A description of Scope 3 GHG emission categories and methodologies is available in our 2023 Sustainability Databook

Physical climate risks have the potential to affect the integrity and performance of our equipment and infrastructure, compromise productivity, and disrupt business continuity (including our supply chain activities). There may also be broader environmental and socio-economic impacts on key stakeholders, including local communities.

Our Sustainable Development Report also includes information about our Governance and Risk Management regarding climate change, which can be found on pages 115-117.

Further documents, including from previous years, can be found on the Annual Reporting Suite page in the Investor section of our website.

Annual Reporting Suite